31+ How to calculate borrowing rate

Trade Value x Annual Hard-to-Borrow Rate Annual Hard-to-Borrow Fee Finally divide the annual fee by. As per the definition stated in ASC 842 one of the new lease accounting standards the incremental borrowing rate is the rate of interest that a lessee would have to pay to borrow on.

Engineering Economics Economy Is How To Spend Money Without Enjoying It Ppt Download

Use our borrowing power calculator to estimate how much you could potentially borrow based on your income regular expenses interest rate and loan term.

. Divide your interest rate by the number of payments youll make that year. ASC 842 and IFRS 16 are similar in the definition of incremental borrowing rate as the rate you would be charged by a bank for obtaining a collateralized loan with the amount. When a company is looking to borrow an asset it will need to borrow money to finance the purchase.

However calculating an appropriate rate is not as straight. If you have a 6 percent interest rate and you make monthly payments you would divide 006 by 12 to. Top Personal Loan Rates Reliable Comparison Reviews Best Rates Quick Approval.

The effective annual interest rate is the interest rate that is actually earned or paid on an investment loan or other financial product due to the result of. It is not the borrowing rate of the company. So the challenge is how to get the incremental birr rate for a leased asset.

Now is the Time to Take Action and Lock your Rate. To calculate the weighted average interest rate of all your loans multiply each loan amount by its interest rate. It is important to understand the difference between APR and.

To calculate your borrowing base. The banks cost of funds reflects its underlying cost when making the. They have matched ANZ at 545 for the one year fixed rate but have set a lower.

ASC 842 defines the discount rate as. This is where the increment borrowing rate comes in the implicit borrowing rate. The incremental borrowing rate is defined in FRS116.

Use the slider to set the interest rate. Add the results together then. 2 days agoTypically HELOC rates move in step with rate increases by the Fed.

You can summarize this approach with this simple formula. The rate usually published by banks for saving accounts money market accounts and CDs is the annual percentage yield or APY. In that case the lessee is.

Ad Were Americas 1 Online Lender. Banks Cost of Funds Credit Spread Interest Rate. Next multiply the trade value by the annual hard-to-borrow rate.

Click here to find a preferred lender. 12 hours agoThis week the average interest rate on a 10-year HELOC is 616 downa bit from 617 the previous week and 620 the high over the past year. Without an implicit rate defined in your operating lease ASC 842 requires reliance on an incremental borrowing rate.

How to Calculate a Borrowing Base. Divide your interest rate by the number of payments youll make that year. Take the value of the assets youre pledging as collateral accounts receivable inventory equipment.

Take the value of the assets youre. 1 hour agoWestpac has now followed ANZ with some 30 bps mortgage rate rises of their own. However calculating an appropriate rate is not as straight.

Ad Low Interest Loans. The current average 10-year HELOC rate is 616 but within the last 52 weeks its gone as low as 255. Choose how much you want to save or borrow.

This will show you how the interest rate affects your borrowing or saving. Enter the amount into the box. 1339 is the annual rate.

Common data points used to start determining an incremental borrowing rate are relevant interest rate yield curves as well as government and corporate bond rates. The IBR Calculator allows users to perform a sensitivity analysis giving organizations the ability to assess the impact of these assumptions on lease portfolios. For a lessee the discount rate for the lease is the rate implicit in the lease unless that rate cannot be readily determined.

At the current interest rate a. Lock Your Rate Now With Quicken Loans.

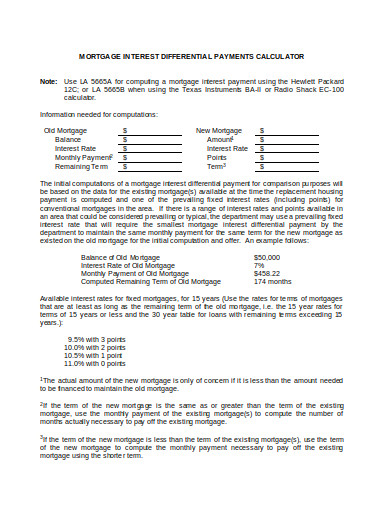

4 Mortgage Payment Calculator Templates In Pdf Doc Free Premium Templates

Engineering Economics Economy Is How To Spend Money Without Enjoying It Ppt Download

Engineering Economics Economy Is How To Spend Money Without Enjoying It Ppt Download

Effective Interest Rate Formula Interest Rates Accounting And Finance Effective

Compound Interest Explanation Examples

Engineering Economics Economy Is How To Spend Money Without Enjoying It Ppt Download

Expanding Compound Interest Equation To Find R Excel Formula Intrest Rate Compound Interest

Calculating Periodic Interest Rate In Excel When Payment Periods And Compounding Periods Are Different Interest Rates Excel Period

Simple Loan Calculator For Excel Loan Calculator Mortgage Calculator Car Loan Calculator

Interest Rate Formula Calculate Interest Rates Interest Rate Chart Math Charts

Pin On Anchor Chart

Simple Interest Compound Interest Continuously Compounded Interest Studying Math Math Methods Simple Interest Math

Engineering Economics Economy Is How To Spend Money Without Enjoying It Ppt Download

Simple Interest Si Calculator Formula Simple Interest Math Charts Teaching Math

Effective Interest Rate Formula Excel Free Calculator In 2022 Excel Formula Effective

How To Calculate Interest Compounding For Exponential Growth Accounting Principles Money Quotes Business Savvy

Calculate Mortgage Rates With The Mortgage Calculator Mortgage Amortization Calculator Mortgage Payment Calculator Mortgage Loan Calculator